Can I Use a Check With an Old Address in 2024?

Have you got a random expense that suddenly needs a check?

So, after dusting off your checkbook, you notice that you have not used your checks since you last moved.

A large majority of people no longer use checks as a regular form of payment.

I personally only use checks for paying my annual snow removal guy and a few other random expenses like a wedding gift.

So, I bet you are wondering, can I use a check with an old address?

The short answer is yes; you don’t necessarily have to go out and buy a new checkbook just to issue that one check.

However, there are some exceptions where you may face some issues, and we will cover those a little later on.

Can I use a check with an old address?

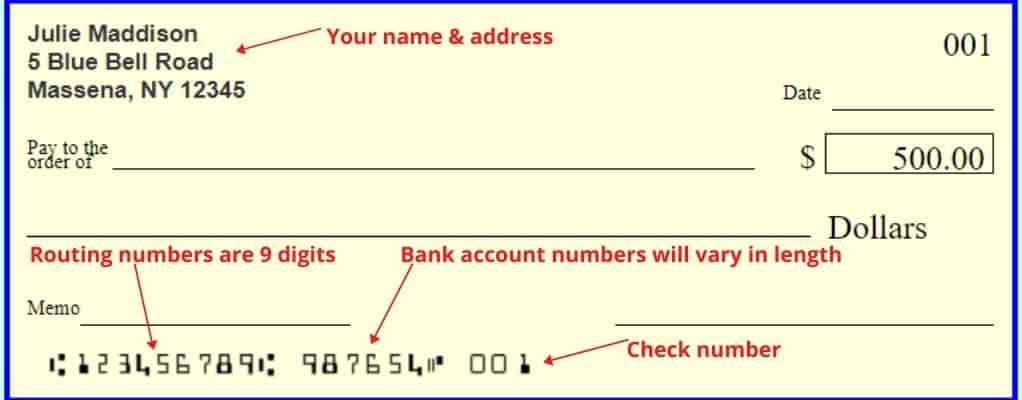

Yes, using a check with an old address is fine in most cases, just as long as the account number and routing number on the check are still accurate.

The receiving bank needs that information to be able to withdraw the funds from your checking account to issue the money to the payee.

It is always best practice to have your documents up to date with the current information, but luckily for checks, there is quite a bit of wiggle room.

It’s important to remember that if any of your banking information changes (routing or bank account number), those checks are no longer in use.

Can I use checks with an old address in Canada?

Yes, Canadians can also use old checks; just keep in mind that Canadian banks work a little differently.

Canadian banks require the transit number, institution number, and bank account number to complete the transaction.

Can you use old checks with the wrong address?

Using a check with the wrong address is basically the same as using a check with an old address.

As long as the account number and routing numbers are correct, the receiving bank will be able to withdraw the funds from your account.

Always review your check order upon arrival for any typos (that can happen more often than you think).

If there is an issue, contact your bank or the business in question for a replacement set.

This post contains affiliate links. We may earn a commission at no additional cost to you if you make a purchase through a link. Please review our disclosure for more information

Do checks need an address?

In reality, having an address on your check is not required under most circumstances.

As already stated, your account and routing numbers are the key elements the receiving bank needs to access the funds.

Occasionally, you may find yourself in a situation where an individual, bank, or business requires that your address be on the issued check.

You would have to fall back on a cashier’s check in those cases.

Given that most cashier’s checks cost an average of $10 each, it can make more sense financially to simply buy a pack of checks.

You can save money by getting a checkbook with 150 checks for as little as $7.46 on walmart.com.

Even if you end up moving, this cost is still lower than the price of one cashier’s check for a new checkbook.

With free shipping included and the option to add CHECKSAFE fraud services for $1.50 per pack, it’s extremely budget-friendly.

If you are only keeping your checkbook around for the occasional use or an emergency, it’s nice to keep things simple by including your name and address.

This way, you do not have to worry that your check may be refused in a pinch.

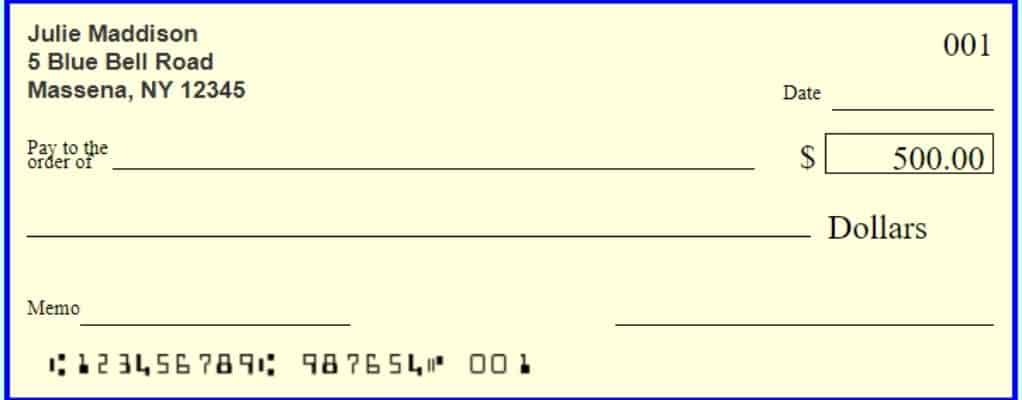

Where do you write your address on a check?

You can locate your personal information on the top left side of each check.

The standard checkbook would include your name and home address in that area.

These days, you can often decide to omit this information from your new checkbook.

Many people prefer not to disclose their name and address and maintain some privacy.

This generally will not cause an issue in most circumstances.

Other important check details

Your checks will always contain your bank account number at the bottom and your bank’s routing number.

How to Change Your Address on Checks?

There are a few different ways to change the address on your checks.

Remember that whichever option you choose, never cover up the routing or account numbers.

- The simplest and cheapest way is to simply strikethrough using a blue or black pen and write the new address above the old one. Include your initials next to the change of address.

Can I put an address label on a check?

If you prefer a cleaner look, you can use address labels instead of using a pen.

There are many different types of labels on the market. Here are a couple of easy options;

- Order some super affordable custom labels. This is my favorite option since they can be ordered to your liking and used for all your other mailing needs, like sending out birthday or holiday cards.

- You can also purchase some printer labels like these and use them to cover the old address with your new one.

For all label orders, just make sure you check the measurements of both your checks and labels before placing your order.

You need to make sure the dimensions will fit.

How old can a personal check be and still be cashed?

On average, written checks are valid for 180 days (or 6 months).

You may find some businesses we will print void after 90 days on the back of their checks.

However, usually, your bank will still cash those checks up to the 180-day deadline.

To avoid any potential issues, it is best to simply cash your checks as soon as you get them.

Plus, the sooner the money is in your account, the faster you can start earning interest or investing those funds.

As for checks that are unwritten (your checkbook), they essentially remain valid indefinitely just as long as your banking information remains unchanged.

Can I still use checks with my maiden name on them?

Sure, but it is the same concept as the rest.

If you are in a situation where the institution requires your name to be on the check, then they will most likely expect the name on the check to match your ID.

They may refuse to process your check if your ID does not have your maiden name.

Note: It is actually more important for the recipient’s name (payee) to be accurate on the issued check and match their IDs.

Affordable places to order checks

Aside from the deals at Walmart for ordering checks, there are some other popular options on the market.

Bradford Exchange

While just a little higher than the cost at walmart.com, Bradford Exchange does still offer checks at an affordable price point.

Try to keep an eye out for any special promotions or holiday deals to stock up on your new checkbooks.

Carousel Checks

CarouselChecks are another good, affordable option, with their value checks starting at $6.99.

They offer an array of personal, business, and accessories. And they are rated 4.4 out of 5 stars from almost twenty thousand reviews.

Checks In The Mail

Checks In The Mail are often recommended online.

While I find their prices just a touch pricier, they often have promo codes like the one provided below.

20% off Personal Checks with code CHECK20

They are a safe and reliable source for ordering checks online and are a key player in the market.

You may, in fact, prefer some of their beautiful check designs.

Costco

Never one to be left out, Costco provides checks in bulk at a great price. Starting as low as $22.11 for executive members, you can get a pack of 250 checks.

The low price difference between the packs of 250 and 500 makes it tempting to buy more. But that’s a whole lot of checks!

Discount Cheques (Canada only)

Unsurprisingly, if you’re shopping for checks in Canada, the cost is not as budget-friendly as that of your US neighbors.

Now, if you are living in Québec or Ontario, you can purchase some nice and affordable checks from Discount Cheques.

Currently, a standard pack of 160 checks will run you $35 (before taxes). They are safe, reliable, and fast to ship.

Plus, if you need business checks, they easily beat the prices of their competitors, such as RBC’s check supplier.

[Related Post: How To Correct A Mistake On A Check]

How to dispose of old checks properly

If you’ve taken the initiative to order a new checkbook, you may find yourself with a bunch of old checks at home. How do you properly dispose of them?

There are a variety of different ways you can approach this.

Just keep in mind that your checks contain your personal information, so it’s not recommended to simply throw them out in the trash.

You’d be surprised at how many people snoop through their neighbor’s trash.

The safest and fastest approach is to use a shredder; that way, your documents will be shredded into small pieces.

You can then separate them into different bags and dispose of them that way.

I always like to keep a shredder at home; it allows me to properly dispose of not just my old checks but any personal bills, medical documents, and other personal documentation that I need to get rid of.

What’s nice is that you don’t have to buy a fancy shredder.

There are many affordable options on the market, and you can just pick one that fits your budget.

When I need a basic product, I always check out Amazon first; they have a great lineup of Amazon Basics (including shredders), which tend to have great product reviews at an affordable price point.

Other popular methods for disposing of checks include using scissors to cut out the private information located on your documents.

Some people like to burn their documents, but if you decide to go down that route, you have to take precautions and ensure that you are doing that in a safe setting where you also have proper ventilation.

Alternatively, you can also take them back to your bank and ask them if they have a check disposal system.

One of my old banks would simply send the checks back to the printer for proper disposal.

At the end of the day, choose the option that works best for you and get those checks taken care of; that’s what matters.

Final thoughts

If you find yourself in a situation where you need to use a check with an old address, luckily, this can easily be fixed with some custom labels, printer labels, or simply using your handy old pen.

In the worst-case scenario where you absolutely cannot use a check with an old address, you can always fall back on a cashier’s check or money order to get that payment done.

Still unsure of how to proceed? Simply call your bank’s branch for guidance.

They can help guide you toward to easiest and most reliable option for your particular circumstance.