52-Week Money Challenge To $10,000 (Free Savings Printable)

Are you excited to start the 52-week money challenge to $10,000 and put it towards your financial dreams?

The 52-week money challenge to $10,000 can initially seem daunting; there’s no denying it.

But remember that each completed week is one step closer to finishing the epic savings challenge.

So try to enjoy the 10K savings challenge for precisely what it represents: a fantastic opportunity to save towards your financial goals or dreams.

Will these savings become your emergency fund, a down payment on a home, a dream vacation, or a step closer to early retirement?

Deciding what your savings will go towards is just part of the fun!

Now, unless $10,000 suddenly falls into your lap (unlikely, right), you’ll need to stick to a plan.

This plan may include trimming the fat from your expenses, sticking to a tight budget, and earning a few extra bucks.

If you need a nice detailed monthly budget template, sign up for our newsletter below and grab your free copy!

This post contains affiliate links. We may earn a commission at no additional cost to you if you make a purchase through a link. Please review our disclosure for more information

Starting the 52-week money challenge to $10,000

Let’s face it: towards the end of the year, thousands of people make New Year’s resolutions to start saving money on January 1st.

But January is also when many families pay off bills from the expensive holiday season.

The beauty of the 52-week challenge to $10,000 is that you can start it anytime.

The challenge doesn’t need to start the first week of the year, running from January to December, just 52 weeks from any starting point.

The 10,000-dollar challenge can be done in many ways; I prefer to start strong with higher amounts and end on a lighter note with smaller payments.

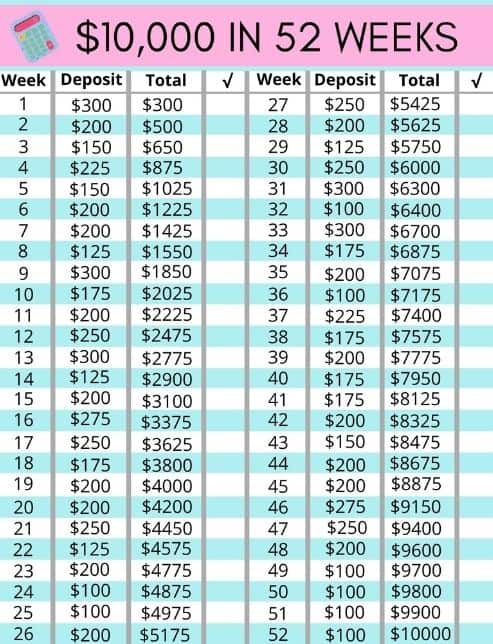

52-Week Savings Challenge Printable

Grab your free copy of the 52-Week Money Challenge pdf; it’s a great way to visualize your goals and weekly savings.

I keep my copy easily accessible on my fridge!

If you prefer to customize the weekly contributions to your family’s preferences, I have a semi-blank copy of the 52-week Money Challenge template available here.

Also, if you prefer physically handling your money and using the cash envelope challenge to manage your cash, that’s fine.

I prefer keeping smaller amounts of cash at home and using a savings account but others thrive on using the cash envelope wallet system.

Finding the money-saving challenge and tricks that work best for you is the key.

You can also save money on cash envelopes by quickly learning how to make a homemade envelope set.

Money-making ideas to help you save more

If you anticipate needing additional funds to make this money-saving challenge attainable, get a jump start by reviewing some side hustle ideas.

This 12 realistic side hustles article is a great way to get inspired.

I’ve used several of these side hustles to cover extra costs over the years and even put some towards my 10,000 savings challenge.

1. Selling cheap eBay finds locally

One of my all-time favorite side jobs is selling affordable goods year-round on Facebook Marketplace, Varagesale, and Kijiji.

These items can be anything from convenient kitchen gadgets and phone accessories to my personal favorite: wedding accessories.

The key is finding something affordable to order overseas from places like eBay, Aliexpress, and DHgate, which have a nice profit margin when sold locally.

This way, you can sell the items at a good profit while providing a service to your local community looking for a more affordable option.

You can always order a few to test the market in your area.

I started with a $5 investment, which seems ridiculous, but it got me five basic satin-trimmed wedding veils at the time.

So take a few hours and search through these sites looking for products. Always sort by Price + Shipping: Lowest first.

Once you find an item of interest, try different keywords, looking for better pricing deals keyworded differently.

2. Cashback credit cards

Credit cards can be helpful, provided you pay off the balance each month (do not carry anything over) and only spend what you can afford.

In my home, we only use credit cards for purchases we already planned to make, such as groceries and gas, or when a credit card is required, like an online order.

Tip: We immediately pay off the balance when we get home or after placing our order to avoid surprises at the end of the month.

You can pay off the credit card balance once your bill arrives by the due date.

However, by paying off each item as you make the purchase, you still earn points but avoid an overwhelming bill at the end of the month.

If you are sure you can make all your payments on time, you can capitalize on cashback perks.

3. Instacart shopper

If Instacart wasn’t already a popular service, 2020 saw its growth skyrocket to unforeseen levels.

The flexibility is great; having a couple of free hours over the weekend, hop on board and fill a time slot.

Sometimes, we can only take on part-time jobs.

Being able to merge multiple schedules with different employers isn’t always possible.

That’s one of the reasons why jobs like Instacart, Post Mates, and Uber Eats have taken off in recent years.

They all provide a flexible way of earning extra money without committing to a work schedule days in advance.

Potential money-saving setbacks

We all know life happens.

You can have the best laid-out savings plan, and faith steps in with some interesting curveballs.

If this happens, remember why you started this money savings challenge.

What does that mean?

If you end the year with $9500 instead of $10,000 because of an emergency, you’re still successful; you’ve improved your financial situation.

Too many people drop and run at the first obstacle in their path, but you can be flexible with the plan and make it work.

If you need to skip this week’s payment, here are some easy ways to catch up;

- If you were temporarily short, double up the following week (not always possible)

- Divide the missed week’s dollar value equally among the remaining weeks left in the challenge (this reduces the burden when you have a lot of weeks left to split it between)

- If you are close to the end of the challenge and can’t double up, add a 53rd week; it’s fine (give yourself grace).

Staying motivated

Staying motivated is vital when participating in a long-term 52-week money challenge to $10,000.

It’s tough to stay on track when trimming out your favorite vices.

It’s still important to reward yourself occasionally, whether with a specialty drink from your favorite coffee shop or picking up a new exciting book.

Just remember to keep it occasional and reasonable.

Some friends like ringing a bell every time they transfer money to their savings account.

It may sound ridiculous, but it’s a symbolic gesture of their ongoing success that keeps them motivated.

Whatever works for you!

52-week money challenge recap checklist

Whenever you need a reminder during the next 52 weeks, remember the following key points to your success;

- Use your Monthly Budget Template to track your expenses

- Stay on top of your weekly monetary contributions by referring to your printed guide

- Tuck your savings away into your savings account or cash envelopes

- Pick a side hustle if you need an extra source of income

- Evaluate ways to handle potential setbacks

- Keep yourself motivated

And if you need some easy savings ideas, here are some frugal living tips.

Over time, even the best savers can sometimes overlook some easy savings strategies.

Why not maximize every opportunity to reach your savings goal even faster?

Another great way to start is by reviewing your budget and finding those quick wins slipping through the cracks.

Other money articles:

If you want to participate in a money challenge but can’t pull that much money from your budget, do not worry.

Check out my other money-saving challenges where there is a fit for everyone linked right below;

I’ve also included more helpful posts on saving and making extra money.

- 12 tips to building your personal wealth

- How to earn cash flipping pallets?

- Highest paying plasma center

- 8+ Side Hustles That Pay Weekly

Remember to pin this post and forward it to a friend who you’d like to join you in taking on the 52-week money challenge to $10,000!